A personal loan is usually an unsecured financial loan selection that borrowers repay in regular monthly installments. You need to use money from these financial loans for all types of company fees or personalized costs.

Your PPP financial loan lender will work with you to file for PPP loan forgiveness. Timing is critical when submitting for forgiveness—You must submit this application within just 10 months of the end of one's coated interval for being viewed as for forgiveness. There are likely to be some types involved; here are some paperwork to investigate:

Keep in mind that you will notice your gross profits with most invoices being an impartial contractor, whilst lenders may possibly request money just after taxes are taken out.

On line competitor info is extrapolated from press releases and SEC filings. “On-line” is described as a person profits tax Do it yourself return (non-preparer signed) which was geared up on the internet and possibly e-submitted or printed, not together with returns prepared via desktop software.

Curiosity fees is often competitive, and financial loan terms and financial loan amounts are going to be dependant on your credit history scores and cash flow. The excellent news is which you can protected one particular of such loans In spite of bad credit score. Every month payments will fluctuate based upon your Mortgage period of time, lender, and loan sum.

A Fundbox LOC is well suited for freelancers that are bringing in a steady stream of money but need to have a lot more time or further pockets to pay ongoing business enterprise fees or suppliers.

Have applied your bank loan for payment substitute—for self-used employees, this might have been a hundred% of your loan. Self-used entrepreneurs also don’t have to worry about such things as salary maintenance.

The applying procedure is simple. Rideshare and delivery motorists can down load the Ualett application and produce a profile; the AI technique does the rest.

Though variable-fee loans may perhaps supply attractive fascination charges, their rates can adjust throughout the personal loan term producing them a most likely riskier choice. This could Charge borrowers more money in the long term and it might be tricky to handle unpredictable regular payments.

You may as well utilize straight to lenders which provide unique products and solutions. This could certainly get you a selected form of financing. Finally, go through an online Market that may match you to definitely a multitude of bank loan choices depending on your prerequisites. This allows you to study distinctive loan alternatives and shop all around to locate the ideal mortgage for you.

As you are able to see, it is a great time to be considered a rideshare driver or gig worker. If you work for any shipping assistance like Amazon, Lyft, or Doordash, there is no shortage of reputable minimal-price cash advance choices for 1099 employees.

Views expressed within check here our articles or blog posts are exclusively Individuals of the writer. The data pertaining to any product or service was independently collected and was not delivered nor reviewed by the corporation or issuer.

The eligibility demands for PPP loan forgiveness are somewhat more complicated for self-utilized borrowers vs. smaller firms. To qualify for mortgage forgiveness like a contract worker, you must:

You won't receive a remaining determination of whether you are accredited for the financial loan until finally once the IRS accepts your e-filed federal tax return. Bank loan repayment is deducted from a federal tax refund and decreases the next refund quantity paid out straight to you.

Jaleel White Then & Now!

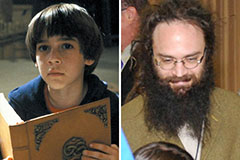

Jaleel White Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!